Introduction

Financial forecasting has always been a cornerstone of business strategy, yet traditional forecasting methods often fail to keep pace with today’s dynamic business environment. Manual processes, static models, and delayed reporting frequently result in inaccurate predictions, cash flow mismanagement, and unexpected costs.

The growing complexity of global markets, fluctuating demand, and interconnected supply chains magnifies these challenges. CFOs and finance teams need faster, more accurate, and more adaptive solutions to anticipate trends and manage costs effectively.

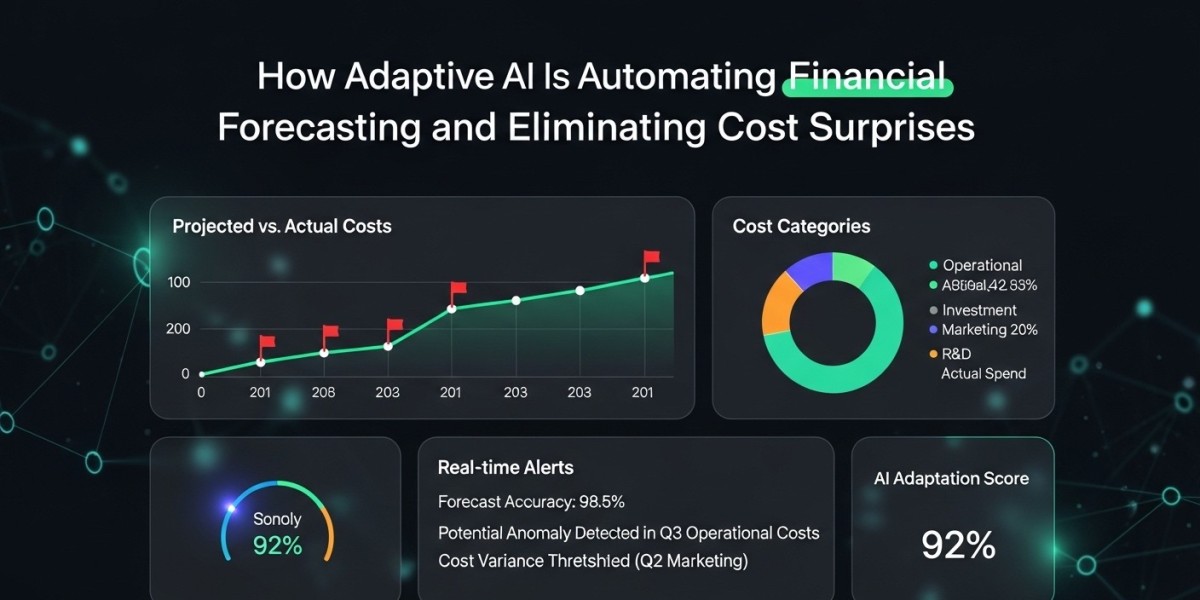

Adaptive AI has emerged as a transformative solution. By continuously learning from historical data, market conditions, and operational patterns, adaptive AI can automate financial forecasting and identify potential cost surprises before they impact the business.

Organizations leveraging adaptive AI development solutions are witnessing a new era of financial clarity, operational efficiency, and strategic foresight. This article explores how adaptive AI is reshaping financial forecasting and enabling businesses to act proactively rather than reactively.

What Is Adaptive AI in Financial Forecasting?

Adaptive AI is an advanced form of artificial intelligence that evolves in real time as it ingests new data and feedback. Unlike traditional models that are static and require manual updates, adaptive AI refines its predictive models continuously, ensuring that forecasts remain accurate despite changing conditions.

In finance, adaptive AI analyzes a wide variety of data sources:

Historical financial statements

Market and economic indicators

Operational and supply chain data

Customer behavior and sales trends

External regulatory and geopolitical developments

Through this holistic approach, adaptive AI generates forecasts that are not only precise but also resilient to unexpected changes. Companies working with an adaptive AI development company gain access to systems capable of turning complex data sets into actionable financial intelligence.

How Adaptive AI Helps Finance Teams

Adaptive AI transforms the way finance teams approach forecasting, budgeting, and risk management.

1. Real-Time Forecasting

Traditional financial models often rely on quarterly or monthly reporting cycles, which can lead to delayed insights. Adaptive AI provides real-time forecasts, enabling finance teams to make informed decisions instantly.

2. Predicting Cost Variances

By analyzing operational patterns and market dynamics, adaptive AI can identify areas where costs may deviate from budgeted expectations. This predictive capability allows teams to address potential overruns proactively.

3. Scenario Planning and Simulation

Adaptive AI can simulate multiple scenarios, incorporating variables such as demand fluctuations, interest rate changes, or supplier disruptions. Finance leaders can evaluate the impact of different decisions before executing them.

4. Automating Routine Tasks

Processes like data collection, consolidation, and preliminary analysis can be fully automated. This reduces manual effort, minimizes errors, and frees up finance professionals to focus on strategic decision-making.

5. Risk Mitigation

Adaptive AI detects early warning signs of financial risk, including cash flow shortages or credit issues, enabling timely interventions that prevent costly surprises.

By integrating adaptive AI development services, organizations can reduce uncertainty and improve both operational and financial agility.

Key Features of Adaptive AI in Finance

Dynamic Learning Models

AI models continuously adjust to reflect new trends, seasonal patterns, and external factors.Cross-Functional Data Integration

Combines finance, operations, sales, and market data for comprehensive forecasting.Predictive Analytics

Anticipates deviations in revenue, costs, and cash flow with high accuracy.Scenario Analysis and Optimization

Evaluates multiple strategies to determine the most profitable or least risky path.Automated Reporting

Generates timely, precise reports for management, investors, and regulatory compliance.Explainable Insights

Provides clear reasoning behind forecasts, ensuring transparency for stakeholders.

These features make adaptive AI development solutions an essential tool for modern finance teams seeking to improve accuracy and efficiency.

Benefits of Adaptive AI in Financial Forecasting

Improved Accuracy: Reduces forecasting errors and cost surprises by continuously learning from data.

Faster Decision-Making: Delivers real-time insights for timely interventions.

Resource Efficiency: Automates repetitive tasks, allowing finance teams to focus on strategy.

Enhanced Risk Management: Detects financial anomalies and mitigates potential issues early.

Scalability: Handles growing volumes of data without additional staffing requirements.

Strategic Alignment: Ensures that financial decisions are closely linked to operational realities.

Organizations using adaptive AI solution development report a marked decrease in unexpected cost overruns and improved alignment between forecasts and actual outcomes.

Challenges Adaptive AI Solves

Data Overload: Integrates disparate data sources and prioritizes actionable insights.

Delayed Reporting: Provides continuous updates rather than static monthly or quarterly reports.

Inaccurate Predictions: Continuously refines models to improve forecast accuracy.

Manual Workload: Automates data gathering, consolidation, and analysis.

Unanticipated Risks: Identifies potential financial disruptions before they occur.

By addressing these common pain points, adaptive AI development services help finance leaders gain confidence in their decision-making processes.

Implementing Adaptive AI for Financial Forecasting

Define Strategic Objectives

Determine what business outcomes the AI should optimize, such as revenue accuracy, cash flow management, or cost reduction.Partner with Experts

Collaborate with an adaptive AI development company to design models tailored to your business structure and financial workflows.Integrate Comprehensive Data Sources

Include finance, operations, sales, and market intelligence data to provide a complete picture.Start with Key Use Cases

Focus on high-impact areas such as revenue forecasting, cost variance prediction, or cash flow optimization.Establish a Feedback Loop

Use outcomes to refine AI models continuously, ensuring that forecasts improve over time.Train Finance Teams

Encourage finance professionals to work alongside AI insights, providing human judgment and oversight.

Adaptive AI development solutions work best when implemented iteratively, delivering measurable benefits while scaling across the enterprise.

Industry Applications

Banking and Investment

Predictive models optimize asset allocation, detect fraud, and manage risk exposure.Retail

AI forecasts seasonal demand, optimizes inventory, and predicts promotional impacts.Manufacturing

Models anticipate production costs, supply chain disruptions, and maintenance expenses.Healthcare

Adaptive AI forecasts patient volumes, resource utilization, and operational costs.Technology and SaaS

Predicts subscription revenue, customer churn, and infrastructure expenses.Energy and Utilities

Forecasts demand, energy costs, and operational maintenance needs.

Across industries, adaptive AI development services help finance teams make informed, proactive decisions and reduce exposure to unexpected costs.

Best Practices for Finance Leaders

Ensure data quality and governance for accurate model predictions.

Foster collaboration between finance, operations, and IT for holistic insights.

Focus on explainable AI to maintain transparency and stakeholder trust.

Begin with high-value, manageable use cases before scaling enterprise-wide.

Monitor model performance and continuously refine algorithms.

Align AI forecasts with broader business strategy for maximum impact.

Following these best practices ensures that adaptive AI solution development delivers both immediate and long-term value.

Future Trends in Adaptive AI for Finance

Fully Automated Forecasting Systems

Systems capable of continuously updating predictions without human intervention.Integration with Real-Time Market Data

Adaptive AI will use live economic indicators, stock movements, and global trends for dynamic forecasting.Proactive Cost Management

AI will identify cost optimization opportunities automatically before overruns occur.Intelligent Scenario Planning

Finance teams will simulate complex business strategies using predictive AI for smarter outcomes.Cross-Enterprise Intelligence

Adaptive AI will integrate data across finance, operations, and marketing for unified, actionable insights.

These trends suggest a future where finance is fully predictive, cost surprises are minimized, and strategy is driven by intelligent insights rather than guesswork.

Case Example: Global Manufacturing Enterprise

A global manufacturing company partnered with an adaptive AI development company to automate financial forecasting and monitor cost variability across multiple production sites.

Within six months:

Forecast accuracy improved by 42%

Cost surprises decreased by 30%

Time spent on manual consolidation and reporting reduced by 50%

Strategic planning cycles accelerated, enabling faster responses to market changes

Adaptive AI continuously learned from production data, supplier performance, and market indicators, creating forecasts that were both accurate and actionable.

Conclusion

Adaptive AI is transforming financial forecasting by turning data overload into intelligent action. By continuously learning, analyzing, and predicting, it allows finance teams to anticipate changes, mitigate risks, and eliminate cost surprises.

Partnering with an adaptive AI development company and implementing adaptive AI solution development empowers organizations to modernize finance operations, improve forecasting accuracy, and make proactive, strategic decisions.